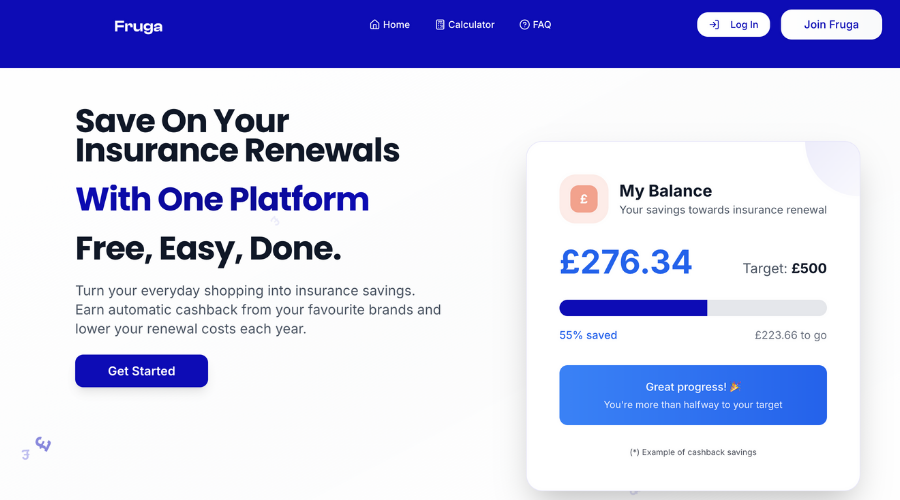

Fruga, a new Manchester-based platform, is helping everyday people across the country reduce the cost of their insurance - without the painful annual switch or endless comparison site searches. Their secret? Turning everyday spending into a way to offset insurance costs, and giving customers real control over one of their biggest yearly expenses.

Behind the movement is Ross McCarthy, a founder with seven years of industry experience and a vision to fight back against a system he once worked within.

“I kept seeing the same thing: loyal customers being hit with rising premiums and no way to control it, while new ones were lured in with discounts to find themself in the same place twelve months later at renewal”

Ross explains. “It was backwards. The people who stuck around were the ones losing out.”

Ross spent years inside the machine, watching customers grow frustrated and tired of the annual renewal roulette each year, forced to jump through hoops just to get a fair price.

So he started asking questions. Hundreds of them.

From online forums to direct surveys, Ross asked UK insurance customers what they wanted. Their message was clear: they were tired of being ignored, tired of false promises, and tired of having to fight for fairness. They wanted a solution, not another price comparison tool, but a way to regain control and ease the burden of one of life’s least rewarding expenses.

From those insights, Fruga was born.

What Is Fruga?

Fruga isn’t an insurer. It’s a digital-first savings platform that works with customers to help them offset the cost of their insurance year after year by tapping into something they already do: spending.

Through partnerships and smart integrations, Fruga lets users earn cashback passively on their daily spending towards their insurance, from their supermarket shop to booking holidays. These savings then go directly toward their insurance renewal, helping customers lower or even clear their costs each year.

It’s insurance savings without the hassle - and without the need to switch providers.

“We’re here to help people save money on the cover they need and not take that for granted. This is a call out to an outdated insurance system”, Ross says.

Why It Matters

Insurance is one of the UK’s largest annual expenses for households, and one of the least transparent. Consumers often feel compelled to engage in yearly comparison-shopping marathons just to avoid creeping premiums. Fruga’s approach is different: reward loyalty, simplify the experience, and give back control.

In a time of economic strain, the timing couldn’t be better.

“We’re building Fruga because the system is broken, and customers deserve better.” Ross adds. “If we can help ease even a little bit of financial stress for people, especially now, then that’s a mission worth fighting for.”

A Local Team, A National Cause

Fruga is proudly built out of Manchester by a small but driven team. They may not have the size or budget of the big insurance players, but they’re making waves where it counts - with real people.

The brand isn’t about flashy ads or big claims. It’s about impact. And the early traction has been promising. More and more customers are joining Fruga, looking for a better way to manage and reduce their insurance costs without the stress they have been used to.

A New Chapter for Insurance

Fruga isn’t just another fintech. It’s part of a growing shift - a demand for fairness, transparency, and real rewards in financial services.

For customers, it’s finally a chance to be treated like more than just a policy number. For the insurance industry, it’s a wake-up call.

“We’re not here to take on insurers - we’re here to make them better by giving customers leverage they’ve never had before”, Ross says. “It’s about rewriting the rules, one renewal at a time.”

And in the eyes of many customers, Fruga might just be the white knight they’ve been waiting for.