Our 2025 Fintech Conference explored the theme of building resilience through intelligence and innovation. Following the conference, we asked the Manchester Digital community: How is your organisation building resilience in a fast-moving financial landscape?

In this post, our members share how they are innovating to stay head.

Slalom

Embedding AI agents

Hugh Freestone – Senior Principal, Data & Analytics at Slalom

Last week at the Fintech Conference hosted by Manchester Digital, I had the pleasure of joining Emily Roberts, Data Platform Lead at Principality Building Society, to share how we’re using AI agents to accelerate and transform data migration.

At Slalom, we’re driven by outcomes that deliver lasting value. When Principality set out to migrate their on-premise data warehouse to Microsoft Fabric—a process initially scoped at 18 months—we partnered to reimagine what was possible. Our solution not only accelerated the timeline but also aligned with their mission to serve members with the same excellence they’ve upheld for over 165 years.

By embedding AI agents into the migration process, we reduced the timeline to just 7 months—without compromising on quality. Our human-in-the-loop approach ensured governance and trust remained central, while AI handled the heavy lifting. The result? A modernised data platform that’s agile, efficient, and ready for the future.

This collaboration is a powerful example of how AI, when thoughtfully applied, can unlock transformation at speed and scale and ultimately help Principality modernise with greater agility and speed, paving the way for accelerated transformation in the years to come.

Find out more about Slalom here.

Together

Leveraging Real-Time Summarisation Technology

Historically, information capture has been a time-consuming manual process. As a leading non-bank relationship lender, Together offers a range of borrowing options, which means we often lend when others can’t. Our underwriters work with more complex customer cases than mainstream lenders, which require longer, more thorough agent summaries.

We wanted a process that would streamline agent summarisations and leverage technology in a non-intrusive way, whilst retaining the high level of detail required for our specialist loan applications.

Working with our omnichannel partner, Content Guru, we adopted a new AI technology, storm® RTAS™ (Real-time Transcription & Summarisation) to assist our advisors by creating summaries of customer applications used to place financial products.

Since implementation, this technology has enabled us to increase quality through automation, cut interaction time and get to know our customers better by helping our colleagues capture information and pass it through to our underwriters.

Taking just three weeks to rollout, the project has delivered significant improvements; 50% reduction in Average Handling Time (AHT), enhanced quality, and increased workforce efficiency. The system has also helped with accessibility for our employees with hearing difficulties by enabling them to listen and not type, knowing that AI is capturing all the detail.

Find out more about Together here.

Hitachi Solutions Europe

Modernising data, operations and governance frameworks

At Hitachi Solutions Europe, we help financial services organisations strengthen resilience by modernising their data, operations and governance frameworks. As AI adoption accelerates across financial services, firms face growing challenges around not just how to unlock insight from data, but how to do so securely and compliantly.

We work with financial institutions to design cloud-based platforms on Microsoft Azure, Dynamics 365 and Power Platform that combine predictive analytics, AI-powered reporting and process automation, while embedding security, data loss prevention and governance controls directly into daily operations. This allows organisations to improve decision-making, reduce operational risk and ensure compliance in highly regulated environments.

An increasing focus for many clients is balancing innovation with control. Deploying AI and automation responsibly, maintaining auditability and protecting sensitive data as regulations continue to evolve. By modernising data estates and applying governance frameworks early, we help organisations futureproof their operations, remain adaptable and build long-term digital resilience in a fast-changing financial landscape.

Find out more about Hitachi Solutions Europe here.

Jaywing

Trust and Digital Connection

Resilience in financial services is built on two things: how well you serve your customers and help them achieve their financial goals but it’s also built on trust; trust that they are getting a good deal, trust that they are getting the right information and trust that their money is safe and their data is secure.

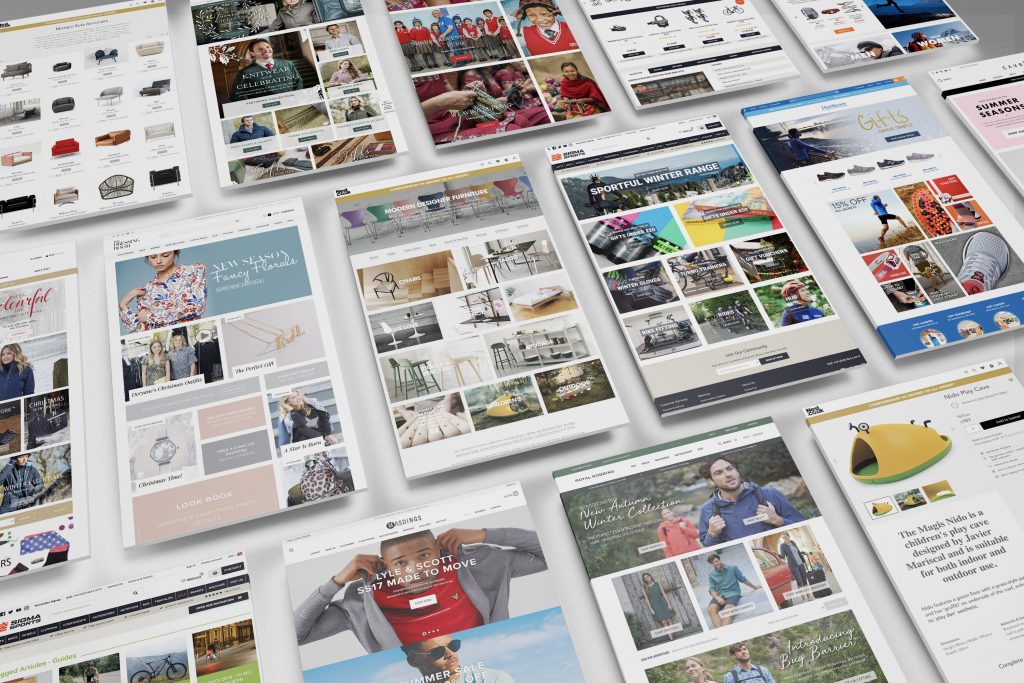

Expectations are higher than ever. People want things to be fast, simple and personal and they expect that from their bank or building society even more so than their favourite retailer. That’s why digital has such a big role to play. It’s about making transactions as simple as possible, but it’s also about telling customers exactly what they need to know when they need to know it. The brands that do this well build trust and loyalty.

At Jaywing, we work with financial services brands including First Direct (who we've partnered with for over 20 years), HSBC, Virgin Money and Skipton Building Society. We help them use data to understand their customers better and turn that insight into a dialogue which feels timely, useful and human.

FinTechs move fast and personalise but they have to work hard to build trust. Traditional providers have a lot of latent trust, but need to work hard to bring their service offer up to the best in class. For both groups, using digital channels to get closer to their audiences is key and for us, that’s what resilience really means: staying connected, being ready to adapt, and always putting the customer first.

Find out more about Jaywing here.

Buymedia

AI, Automation and Smarter Media Strategy

At Buymedia, we understand that staying ahead means constantly adapting and innovating. Our commitment to intelligence and innovation is at the core of how we empower businesses to navigate this dynamic environment and build lasting resilience.

We leverage cutting-edge technology and data-driven insights to help our clients optimise their media spend and achieve their marketing goals. This means harnessing the power of AI and automation to identify key trends, predict market shifts, and fine-tune campaigns for maximum impact. A key differentiator in our approach is the use of AI-powered personas for precision targeting. By creating sophisticated, data-rich AI personas, we gain a deeper understanding of audience segments, allowing us to deliver highly relevant messages to the right people at the right time. This transformation of complex data into actionable intelligence enables our clients to make smarter, faster decisions, ensuring their marketing efforts are not just effective but also highly adaptable to changing market conditions.

One of the biggest challenges in a fast-moving sector like FinTech is staying secure and compliant while remaining agile. Our platform is designed with this in mind, providing a robust and transparent framework for all media transactions. This not only streamlines operations but also provides the peace of mind that comes with knowing your media investments are handled with the highest standards of integrity and accountability.

For us, futureproofing means continuously refining our services and expanding our technological capabilities. We're always exploring new ways to enhance our platform, ensuring that our clients are always equipped with the most advanced tools to reach their audience and grow their business. By focusing on intelligent automation, AI-driven insights, and precision targeting through AI personas, Buymedia helps organisations not just overcome current challenges but also anticipate future ones, building a truly resilient foundation for sustained success.

Find out more about Buymedia here.

ICit

Smarter Planning for a Smarter Sector

In today’s fast-moving fintech sector, resilience is no longer a luxury - it’s a necessity. With shifting market dynamics, increased regulatory pressure, and constant competition, finance leaders need more than spreadsheets and instinct to navigate uncertainty. They need intelligence. And they need innovation.

At ICit, we’ve spent 25 years helping finance teams build resilience by replacing rigid, manual processes with agile, insight-driven planning. Using Workday Adaptive Planning, we empower fintech firms to adapt faster, forecast smarter, and collaborate better.

Why does this matter? Because resilience in fintech isn’t just about surviving downturns - it’s about staying ahead. Adaptive Planning delivers real-time visibility into performance, enabling scenario planning that caters for market shocks, customer behaviour shifts, or funding volatility.

Intelligence means knowing where the business is going. Innovation means building a system that gets you there - without relying on IT or legacy tools.

Fintechs who partner with ICit and Workday Adaptive Planning can expect up to 50% time savings on budgeting and forecasting, enabling teams to focus on strategy, not spreadsheets.

In a sector built on disruption, the winners are those who plan better, faster, and with confidence.

Resilience isn’t reactive. It’s designed. Let’s build it together.

Find out more about ICit here.