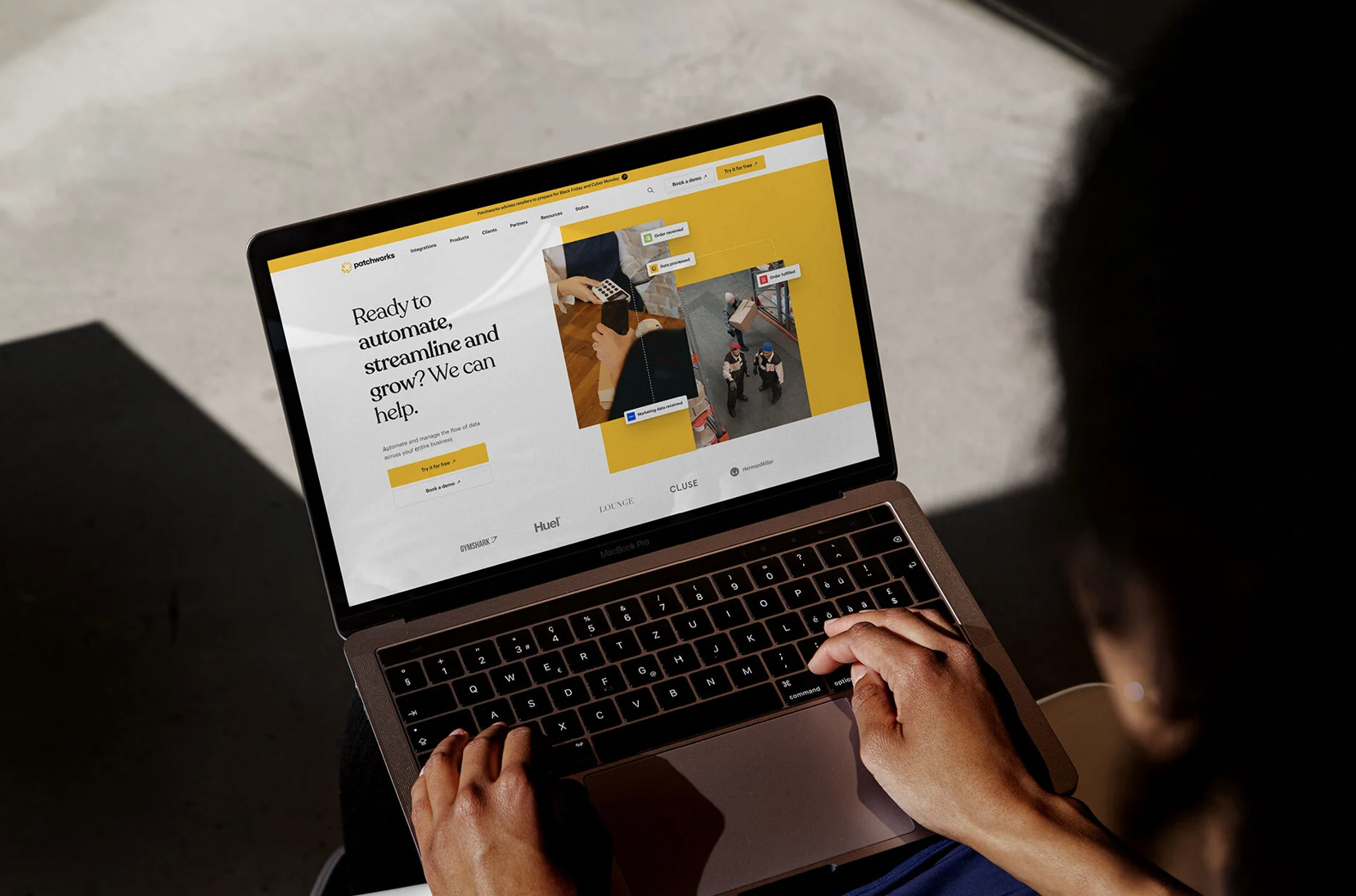

Palatine has provided Patchworks with £2 million in funding, supported by investment from Gresham House Ventures, who back high-growth businesses with flexible capital.

The funding will fuel its growth, and go towards improving the efficiency of its platform, as well as onboarding new blue-chip clients. It will also support its expansion into the US market.

The deal marks Palatine’s seventh from its Growth Credit Fund, which launched in January 2024 to support maturing, high-growth companies in the UK regions which are seeing double-digit year-on-year revenue growth.

William Chappel, Managing Partner for Palatine Growth Credit, said: “Patchworks is an outstanding business, offering a best-in-class e-commerce system for some of the most significant retailers in the industry. Its leading software is responsible for the smooth running of backend operations that are crucial to the retail sector.

“With a presence in Nottingham along with its fast rate of growth, Patchworks is a great fit with the Growth Credit Fund’s mission to support regional businesses with tailored growth capital.”

Jim Herbert, CEO of Patchworks, added: “We are so pleased to have Palatine onboard as we look to grow and scale further, along with onboarding some major players in the retail space.

With their support, we will be able to offer an even more seamless experience for retailers, ensuring Patchworks continues to be one of the leading e-commerce platforms.”

The Palatine Growth Credit Fund supports companies in the cyber, fintech, SaaS, healthtech, medtech, AI and advanced manufacturing sectors in the burgeoning technology ecosystems of the North, Midlands, South West, and the South East.

The fund sits alongside sustainably driven investor Palatine’s established Buyout and Impact private equity funds.

Palatine was advised on the deal by Scott Morrison at Addleshaw Goddard LLP.