Against that backdrop, acquiring an AI business is a strategic move that can unlock innovation, accelerate growth, and future-proof operation – a fact reflected in the huge surge in M&A activity focused on AI businesses over the last few years.

However, AI acquisitions are complex, requiring a unique blend of technical, legal, ethical and strategic due diligence. As such, aspirant buyers of AI businesses need to be prepared to undertake an extensive and, at times, forensic analysis of the target business and its proprietary tech to ensure its value is real.

This article aims to highlight a few of the more unique issues associated with acquiring an AI business and offers those buyers some points to consider.

1. Know your target – do your due diligence

Technical and product

Fundamentally, any acquirer of a business producing an AI product will want to validate that the product does what it says on the tin and that the technology – whether based on probabilistic models, data-driven learning, continuous iteration or another system – works as anticipated. At the same time, the acquirer should ensure it is comfortable with the technology’s state of development and performance, and that its continued development and performance can be achieved post-completion.

To ensure this is done effectively, the acquirer may wish to consider engaging AI engineers and data scientists who can validate claims and identify hidden risks. Points that should be considered will include:

- Whether required performance benchmarks (eg, accuracy, latency and robustness) have been achieved. If not, additional investment may be required to meet those not yet met.

- What datasets were used to train the models and whether these are proprietary, licensed, or publicly available. Lower quality data will harm the AI’s development while dependence on licensed or publicly available data could impact its long-term viability.

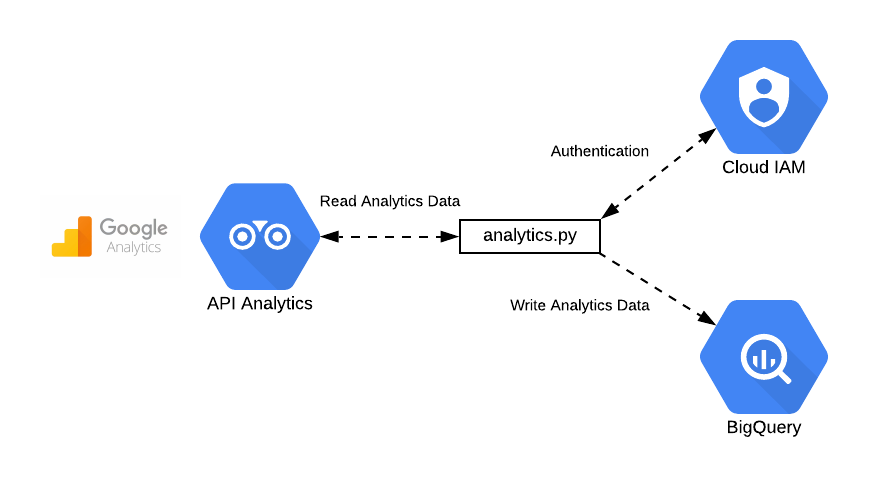

- Whether the technology is scalable – for instance across geographies – and how it operates when faced with different business or customer segments. Linked to this, the acquirer should consider what cloud or edge infrastructure supports deployment.

Intellectual property and data rights

In contrast to a business producing tangible assets, AI businesses derive their value from IP. Ownership of and the right to use this IP will be pivotal to realizing the target’s value. Thorough analysis should therefore be carried out to ensure that:

- There’s clear IP ownership – or robust licenses are in place in respect of – the AI’s code, models, and training data. This will, of course, include appropriate provisions being included in contracts with employees, contractors and collaborators.

- The business has a developed IP strategy in place. For instance, does the company have patents protecting core innovations and is proprietary information adequately protected through NDAs?

- The business has complied with its obligations under GDPR and other data processing laws. Failure to do so could lead to litigation, reputational damage and restrictions on the technology’s usefulness.

Regulatory and ethical compliance

The sector is increasingly regulated and ethical failings can be costly – both in financial and reputational terms. Unfortunately, as AI models are trained on existing data sets, societal basis can be entrenched into their methodologies.

Any acquirer should take the time to investigate the fundamental basis on which the model has been created. Key focuses should include:

- Whether the target can explain how its models make decisions. An understanding of the model’s foundations and the data sets created or used by the target will help ensure its transparency in the future.

- Whether the company follows recognized standards, such as the EU’s Ethics Guidelines for Trustworthy AI and whether the company has established mitigation strategies if bias or unfairness issues arise.

Talent and culture

AI businesses are often built around small, highly skilled teams and retaining this talent post-acquisition will likely be critical to the business’ future success. As part of the due diligence process, the acquirer should ensure it’s identified the key personnel in the business and reviewed their terms of engagement to ensure they are incentivised, at least within market expectations, and are unlikely to leave the business on completion.

Commercial risk and data protection

The target’s contractual nexus should be interrogated carefully to ensure there are no issues integrating the systems into the acquirer’s business. In addition, the acquirer will want to ensure:

- contracts with third parties allocate risks appropriately, and any warranties and indemnities, performance guarantees and limitations on liabilities are identified

- the target has appropriate insurance cover in place for AI-specific issues, including IP infringement, data breaches and algorithmic liability

Regulatory scrutiny and antitrust

Finally, AI deals are likely to attract attention from regulators. This is especially true in sensitive sectors. Any acquirer should engage advisers to opine on whether the transaction is likely to fall within the remit of the NSIA (in particular, defense, life sciences, infrastructure, or businesses dealing with sensitive data may trigger a need to make a formal notification through the National Security and Investment notification service) or whether the consolidation of data assets or AI capabilities raises any competition concerns.

2. Protect your target – transaction structure

Warranting the product

The transaction documents governing the acquisition should include a suite of warranties (and potentially indemnities) confirming fundamental aspects around the business’ operation, finances and assets. Specifically in respect of the AI product – and in addition to usual warranties around IP ownership – the acquirer should consider seeking warranties around:

- the AI model’s accuracy, bias mitigation and regulatory readiness

- cybersecurity and data breaches to provide comfort against breaches and misuse

Incentivisation and future performance

The documents should also establish a suite of protections to mitigate future risks inherent in the business, potentially including measures to defer consideration against ongoing development or performance milestones. Notably – and as above – AI businesses are often built around small, highly skilled teams and retaining this talent post-acquisition will likely be critical to the business’ future success.

Any acquirer should consider:

- Whether new retention strategies should be put in place following completion. Beyond typical bonuses structures, the acquirer could consider share incentivisation schemes or creating new leadership roles for top talent.

- Where key employees are also sellers, whether post-completion incentivisation, such as earn-out structures and milestone payments, are appropriate.

Integration post completion

Finally, post-acquisition success will depend on thoughtful integration. For instance, the acquirer will need to be sure how the AI stack is to be integrated with existing systems and whether APIs, data formats, and infrastructure are compatible.

Finally the acquirer will need to ensure the AI team being brought across can be effectively integrated into the acquirer’s business.

If you’re thinking of acquiring an AI business and wish to discuss any of the issues raised in this article, please get in touch with the author of this article or a member of Mills & Reeve’s corporate team.

Our content explained

Every piece of content we create is correct on the date it’s published but please don’t rely on it as legal advice. If you’d like to speak to us about your own legal requirements, please contact one of our expert lawyers.