For the latest #SeniorTechTalk we’re joined by Mark Hartley, Founding Partner of BankiFi, to discuss how they are working with banks to help their small business customers, the potential of open banking and the development of Manchester's fintech ecosystem.

Could you begin by telling us a little bit about BankiFi and your journey so far?

BankiFi was established in 2016. Classic startup, which was me with one developer explaining what I wanted to build. I had identified that small businesses (anything from sole traders all the way up to companies around the size of perhaps 40 or 50 employees) had been very underserviced by banks. And that was largely because banks didn't understand them and they weren't seen as profitable, because banks had traditionally had a model of relationship management which meant it was too costly for a bank to make money out of small business, so they sort of neglected them.

We set up BankiFi specifically to help banks better understand their customers and offer services that were going to help their small business customers run and operate their businesses more efficiently. So rather than just the bank selling them a product, such as an account or a loan, we embarked on building a suite of services that help a small business run and operate.

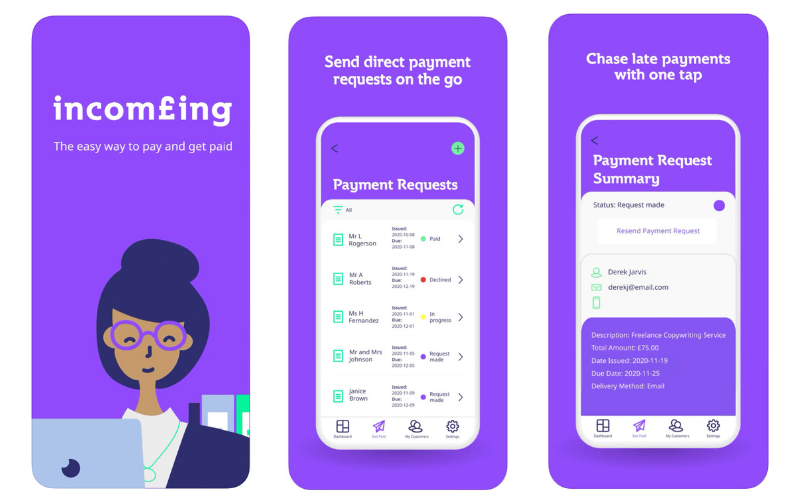

So for instance, we’ve built an invoicing service, we’ve built a payments and collection service, we’ve built connections into the accounting packages, we built an accounting package of our own that the bank can whitelabel which is less complicated and more oriented to the small business than perhaps the likes of Xero, Sage, or QuickBooks.

And then what we also do is offer insights, tips and nudges to help small businesses run more efficiently using the data that we collect from both payments and connections into the accounting packages. We have this concept of embedding banking inside your workflow as a small business, so really what we do is to help banks better understand more businesses, offer more tailored products and services that help the business operate rather than the bank just trying to sell them a product.

And what is your role within the business?

I was the founder of the business, and I'm also the CEO. So, as I mentioned we started with just myself and one developer, and that has now grown to around 30 others and we've got offices in Belgium, Holland and new ones just opened in Australia and Singapore, as well as in Manchester.

So I have the oversight of all of that, but my main day-to-day focus is running the sales and marketing team. And, as the founder and CEO I get involved in every aspect of the business really.

What sort of opportunities does open banking present for businesses such as yourself, and how does the technology you’ve developed use that potential?

I should probably begin by explaining what open banking is. Open banking really was a move by the Competition and Markets Authority in the UK, and similar authorities and regulators around the world, to effectively provide competition.

Banks have predominantly had a monopoly on providing payments services and other services to consumers and small businesses. What open banking is designed to do is to enable those services to be available via third party, so other regulated entities that don't need a banking licence and don’t need to be regulated to the same level as a bank can offer payment services to consumers and businesses.

That was really interesting for us, because although we're trying to help banks and we sell our services to banks, what the banks initially did was they made their services comply with the regulation, rather than looking at it as an opportunity to do things better themselves. They looked at it as a way of having to make their services available through this new regulation. And what that means is they really had to open up their systems to be accessible by APIs and application programming interfaces, so that non-banks, or third party processes as the regulation defined some, can get access to a customer's bank account and make payments on their behalf provided the customer has given them consensual access to do that.

This opens up a whole host of things that you can do. For example, if you can get access to the data within an account and look at the transactions, you can understand a business and that can help you make better informed lending decisions, for example, or it allows you to make a more streamlined payment process that isn't necessarily going through your banking interface. From a bank's mobile or internet banking connection, you can embed that inside an e-commerce workflow or a payment workflow.

A specific example would be that the UK has a massive problem with small businesses being paid late. Something like 80% of our small businesses have invoicing terms of 30 days, but prior to COVID, that would take 56 days to collect. So in other words, you've got a late payment problem of about 28 days. Add COVID to that and it’s risen to about 71 days! So we have built a service that uses open banking to help businesses collect money on time, so we have become the regulated entity that instructs the payment. So it means that we've been able to create a workflow that allows a small business to send a request to their customer to be paid, and we facilitate the payment rather than the bank. This could sound scary to the end user, but actually it doesn't mean that we are actually making the payment on their behalf. What open banking really is, is an overlay of service on top of the existing bank infrastructure.

So for example, if I were to send you a request for payment, what we would then do is redirect you to your bank, where you would put your credentials into your bank site, and the payment would go through. We don't need to know your sensitive data, we don't need to know anything about your account number or your source code, we just effectively facilitate and orchestrate the payments so they can happen more efficiently.

That is what open banking really allows. It's areas around payments and around getting access to the data that resides in an account. It's about real time lending decisions and better processes for consumers and small businesses. And not just in the UK - that's across the whole of the European Economic Area, and also in about 35 countries outside of Europe. It's a global phenomenon.

How do you go about working with banks and getting them to help their small business customers using your product?

So, in that respect, this is where I don't like to be described as a fintech.

Fintech is an industry that has grown up in the last 10 years, where really these technology companies have been disrupting and taking services away from banks. They've been responsible for a fashionable term which refers to banks being unbundled, ie the services that banks provide are being now provided by alternative providers, which are commonly known as fintechs.

The reason I don't like that term for us is we're not trying to unbundle or remove or take away things from banks, we're actually trying to help them move into the 21st century and work with their customers, to provide their customers with better services. So we're a traditional financial technology supplier to banks, we're not someone that's trying to take away market share from them. We do that by talking to their IT departments, talking to the business owners and acting more as a partner for them than anything else.

It's interesting that the biggest challenge that you face when selling into a bank is the IT department, because the IT departments always think that they can build it quicker, better, faster and cheaper. Invariably, that's wrong because they have so many things that they need to do, and so many resource constraints. So the biggest challenge that we face is convincing the IT department that we're not a threat, that we're actually a partner, and we're actually going to make their lives easier. But we have long sales cycles (which can take 12 to 18 months) as banks are heavily regulated and bureaucratic, large organisations with various hoops that you have to go through to strike a deal.

What impact has COVID-19 and the events of the past year had on your business and the sector at large?

I'll start with the positives as there's been an awful lot of understandable doom and gloom around COVID. But for the types of things that we do, and first and foremost we're a technology company, so the move to not working in an office was quite seamless. For us, we already had people working a few days a week remotely, so we just transitioned that to being 100% and that was really very seamless for us.

On the business side of it, a lot of what we do is facilitate digital payments and it's well documented that the move away from cash was already on the demise prior to COVID, and that's just been catalysed as a consequence of COVID.

So for example, some of our customers are businesses who don't take cards as a payment method. Over the last year everyone has become familiar with QR codes because of the COVID-19 NHS app and other things, and we've built a payment service that allows a customer, a sole trader such as an electrician at your home for example, to create a bill on their phone with our app that is branded as the bank’s, and all the information is contained inside a QR code. When you, the payer, put your phone over that QR code it immediately fires up your mobile banking app and you can then make that payment by just using your biometric fingerprint or your face ID. So that that type of thing has been catalysed and brought forward and is a real positive as a consequence of COVID.

On the downside, we weren’t able to open the offices that we targeted opening in 2020 because of physical restrictions and so forth. A mixed bag is a way to describe it from our point of view, but it's certainly not all negative and I think some really strong positives, such as better work/life balances and flexible ways of working, will come out of it.

With lockdown restrictions starting to relax over the next few months, what are the main challenges your business faces in a post-pandemic world, and what opportunities lie ahead?

As I said, we were going to open an office in Australia and Singapore in 2020, which we’ve now achieved and we hope to do the same thing in the US later on. I do think the world will start moving again and with that comes some major opportunities, but I don’t think we’ll be going back to the normal we knew before.

I’ve mentioned ways of working and work/life balance, but another real benefit I think we’ll see, particularly for cities like Manchester, is that we’ve been playing second fiddle to London for a long time. This is particularly true in the fintech sector, and everyone thinks that the UK fintech sector is almost 100% centred around the Shoreditch roundabout in London. So what this presents for us here, for people that have chosen to come to our city to study, they no longer have to leave and chase what they think are the bright lights of London. People will have the opportunity to work remotely from anywhere. And that means more job opportunities for people that have chosen to live in and around our city, and people won’t feel like they need to move away or jump on a train at a silly time every morning to London.

A lot depends on whether you’re a glass half full or half empty type of person, but personally I think you've got to be optimistic about the opportunities that COVID will have created to make fairly radical changes to people's lives in a positive way, but also for regional cities like ours, and post COVID, post Brexit we're all going to have to stand up on our own two feet. So I'm very bullish about the opportunities that have been created by both Brexit and COVID for Manchester.

It’s well documented that Manchester has developed a thriving financial technology sector with a considerable number of startups in the area alongside more established players. Why do you think this is, and how important is it to BankiFi to be part of this community?

I think that that's one we could talk about for hours. I'm a proud Northerner and a proud Mancunian and I think that goes right back to what a great place it is to live. We often talk about work/life balance and how you should work to live not live to work, and a lot of people come to our city as we've got a fantastic array of things to do, whether that's football, music, theatre, arts, etc.

I think our challenge has been making it available for people to stay in and around the city rather than feeling like it was a place to come to study and have a good time in your 20s but then depart for London. I think that's radically changing now due to all of the opportunities here. We’ve got fantastic education establishments with wonderful courses, and a really rich heritage. The cost of employing people here and the cost of living, compared to London, are really beneficial and the amount of building work in and around the city has created plenty of reasons for people to stick around.

So there's loads of ingredients as to why we've become, not just a fintech, but a technology hub. The question is how are we going to take advantage of that? One of the things I had a real issue with was the offshoring model. It was always viewed that we could get cheaper, better talent outside of the UK, so we've actively taken part in something that we call youth-shoring, where we want to give young local people an opportunity to work in the industry that we are in. There's a number of really good organisations in and around Manchester that retrain people into development scenarios. One we work very closely with is Northcoders. We've taken a number of folks from their retraining programme and given them their first opportunity into working in financial technology. It’s an opportunity to take very clearly motivated and ambitious people who've decided that they're going to pay for themselves to be retrained in software development, which shows a real level of dedication and desire, which is a really good quality to have.

Similarly, there's a couple of very interesting recruitment agencies that specifically target third year undergraduates to get them their first job out of university. It's that type of thing that we can leverage now, because as I said, all the ingredients are here and if you add in the opportunities of remote working and staying around the city they chose to study in, it means we’re able to take advantage of local talent, rather than saying it's cheaper to go offshore.

Are there any challenges that Manchester’s fintech sector is facing as a whole, and if so what sort of support does it need?

Certainly, I think one of the big differences between London and anywhere else in the country is that the access to finance is so much better and easier in London. Now, there are some notable examples of that being different and some great companies who are really backing local businesses. But they're few and far between. So I think one of the biggest challenges for any sector, fintech or otherwise, is that we get better, knowledgeable investors. There's a great angel investment community in Manchester, but I'm talking more about venture capital which is not as good as it could be.

We’ve got some brilliant examples of the private and public sector working together well in Greater Manchester, and Manchester City Council and The Growth Company do brilliant loans and financing for your early stage companies. I think there needs to be more of that from central government. Local government does a good job, but it could probably do more. And as I say, more venture capitalists, in and around the regional cities and our own city would be better because this is an area where London is better equipped than we are.

Finally, are there any fintech trends that you’re particularly excited about or that we should look out for over the next 12 months?

I think this is one where I look at things that are already out there, I think Gartner describe it as the hype circle, you see the things that are going to be big things in the future and then they mature and actually become a thing. So for instance, we've been hearing endless stories about blockchain and crypto and digital currencies, and also artificial intelligence. But I do think this year is the year for open banking to really become mainstream.

You know, open banking was launched in 2018. And the problem with a lot of these things is there's too much jargon and there's too much industry navel gazing about why it should take off and when it does what the benefits within the industry will be. We often don’t hear what the benefits to the end user. I try to avoid talking about open banking and much prefer to talk about the value and the benefits that it brings to the end users.

So for example, why I think it's one to watch this year, simple things like HMRC now making it mandatory for any of the tenders that they put out there to have the ability to pay using an open banking model. So similarly have the Department of Work and Pensions. We saw last year that there were over 2 million users of a payment method instigated by open banking. And that's growing and growing. So I think this year is the year that open banking becomes mainstream, and that people actually start to see the value in the benefit of it.

It is so much cheaper to pay by a bank transfer than it is by a debit or a credit card. So whilst you may get protections with credit cards, for people to take payments via a card payment is incredibly expensive and they can spend hundreds of thousands, if not millions of pounds a year in fees associated with collecting money via card, whereas bank transfers is a fraction of that cost. And that's what open banking facilitates.

It might sound a bit dull when there's people talking about blockchain and AI etc, but the reality is that there are some real short term things that we need to think about instead of always thinking about the future and long term - there's problems that need to be solved here and now. I go back to that point I made earlier about late payments being a massive, massive problem in this country and the combination of open banking and request to pay, which is a service around open banking, has a major role in getting on top of that late payments challenge.

Thank you Mark!

To find out more about BankiFi, click here.

Want to raise your company's profile?

If your company would like to feature on our website, across our social media and in our newsletter, contact thom@manchesterdigital.com for more information.