Our last post in the VC Insights series looked at methodologies for taking the headline valuation and turning it into a price per share that accounted for cash, debt, and the option pool. We’re now going to look at some further necessary adjustments due to convertibles and non-diluting shares.

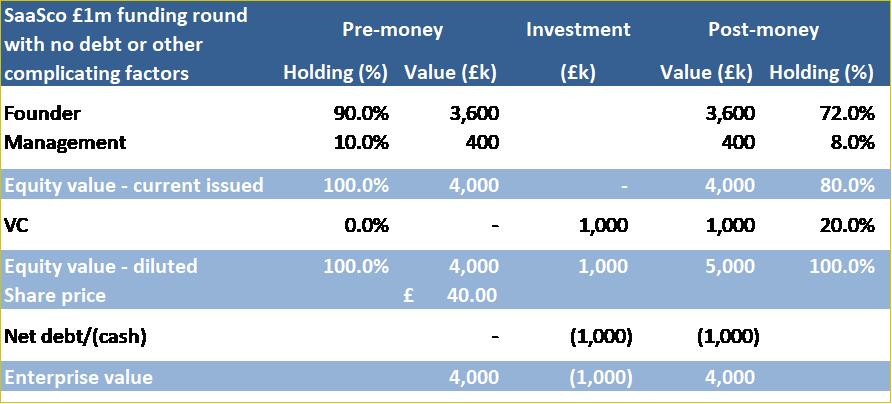

As a recap, this was our starting point:

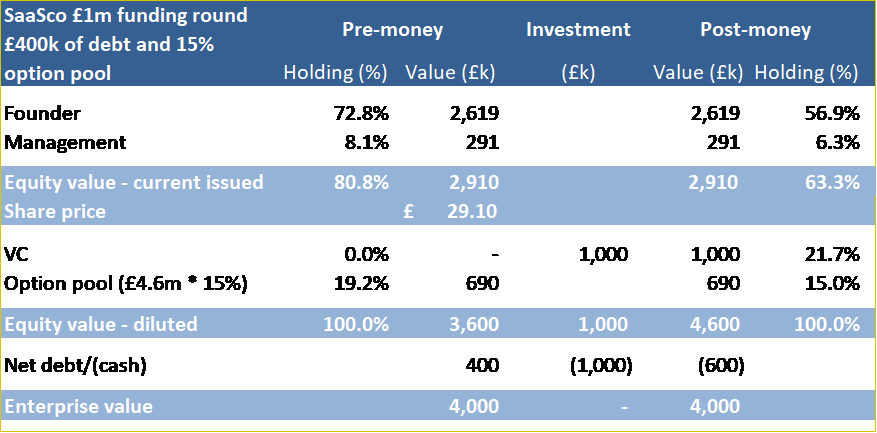

And this is where we had got to after adjusting for £400k of debt and a 15% options pool:

Convertibles

Exactly how we adjust for a convertible loan depends on its terms. These might, for example, prescribe that the loan converts at a discount to the price in the next equity raise. We need to make sure, if conversion is not automatic, that the loan note holder agrees to convert at the same time that we invest. Let’s assume that SaaSco’s £350k loan is convertible and the holder has duly agreed to convert the loan on our investment; the conversion terms allow for them to subscribe the loan note for ordinary shares at, say, a 30% discount to the price that we pay. So, the true value (or, from the company’s point of view, cost) of the loan note becomes:

- £350k / (1 – 30%) being £500k, a £150k uplift on the principal value.

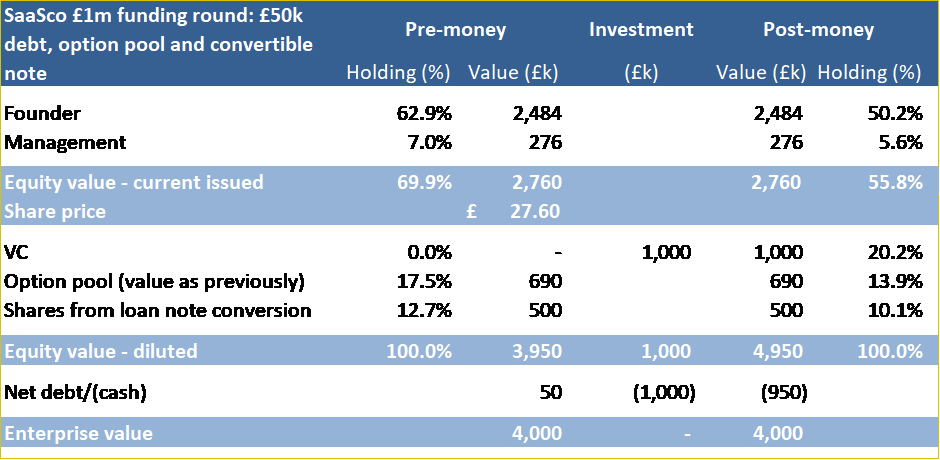

Let’s revisit the cap table including the £350k loan conversion to £500k of equity just before we invest. This conversion leaves just the £50k of overdue taxes as debt, so the post money valuation is £4.95m.

The value of the option pool would increase slightly if we held it at 15% of the post-money share capital but, for simplicity, we have held the value constant and flexed the percentage instead.

So, this is what the convertible scenario cap table looks like, with £50k of debt, a £350k loan note converting into £500k of equity, and the option pool fixed at £690k value of shares:

The issue price of the new shares has fallen again, from £29.10 after inclusion of the options pool to £27.60, and the investor will again receive proportionately more shares. This reflects the dilution from the £150k conversion premium on the convertible.

The investor’s stake has decreased slightly (but as always, its value remains unaltered at £1m). This is because the post-money valuation has increased as most of the debt has been eliminated. The Founder now holds a slightly reduced share in a more valuable company.