By Manchester Digital member Alexander & Co, who provide expert advice on R&D tax matters

The UK government has recently restructured the research and development (R&D) tax credit framework, introducing changes that impact digital and fintech companies. The new R&D Merged Scheme is available to companies of all sizes and can be useful for companies in the Digital and fintech sectors, where tax relief can be claimed.

Understanding R&D Tax Credits

R&D tax credits are a government incentive designed to reward UK companies investing in innovation. If your business is involved in developing new products, services, processes, or enhancing existing ones, you may be eligible for research and development tax credit relief. This is especially relevant where activity is through innovative software development or data-driven platforms.

To date, this support has enabled fintech and digital firms to offset R&D costs, reinvest in innovation, and scale their operations effectively.

Introducing the R&D Merged Scheme

The government has now launched a merged R&D scheme, combining the previous SME R&D tax relief and the R&D Expenditure Credit (RDEC) into a single system. This applies to R&D activities in accounting periods beginning on or after 1 April 2024. The merged scheme aims to level the playing field for companies of all sizes and simplify the claims process.

Key features of the merged R&D scheme include:

- A 20% taxable credit on qualifying R&D expenditure

- The same rules apply to both SMEs and larger companies

- Amended compliance requirements, including digital submissions and claim notifications

- Applicable mainly to UK-based R&D activities, with limited eligibility for overseas costs

Enhanced Support for R&D-Intensive Companies

For loss-making digital and fintech SMEs, there's an additional opportunity: the Enhanced R&D Intensive Support (ERIS). If your company's R&D expenditure accounts for 30% or more of your total costs, you may qualify for a higher payable cash tax credit rate of 14.5% on surrenderable losses.

This is significant for early-stage fintech startups or scaling SaaS platforms that need cash but are still pre-profit and heavily invested in product development.

Importance for Digital & Fintech Companies

Fintech and digital businesses are among some of the most R&D-intensive sectors. Whether you are building advanced blockchain platforms, developing AI-driven applications, or enhancing digital payment solutions, your R&D efforts likely qualify for tax relief.

The benefits of claiming for R&D activity include:

- Offsetting large development costs for software, AI, cloud infrastructure, cybersecurity, etc.

- Improving cash flow with payable cash tax credits if your company is not yet profitable

- Reinvesting savings into talent acquisition, growth, and product development

- Attracting investment by demonstrating the utilisation of UK innovation incentives

Navigating R&D Tax Credit Claims

To claim under the new R&D merged scheme, companies need to:

- Notify HMRC of their intent to claim within six months of their accounting period end. (This is for first-time or returning claimants).

- Submit a comprehensive digital report detailing R&D activities, associated costs, and justifications.

- Ensure compliance with new requirements concerning subcontracting, overseas R&D, and cost categorisation.

Early action is important as deadlines apply. Delays or omissions can lead to missed opportunities. With increased scrutiny from HMRC, accurate and well-supported claims are more important than ever.

Identifying Qualifying R&D Activities in Digital and Fintech Sectors

Your company might be eligible if you are:

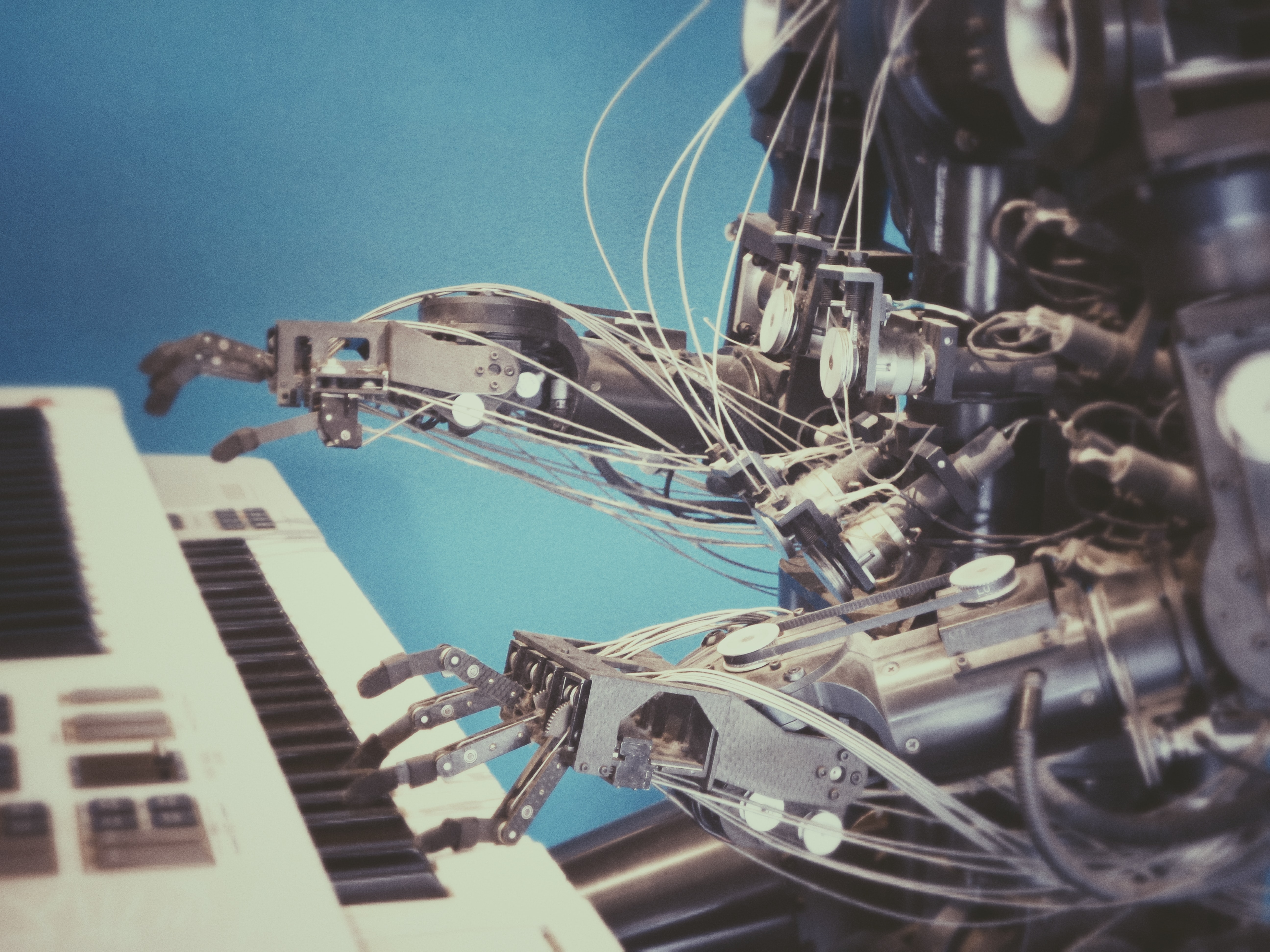

- Developing custom software or integrating APIs

- Creating new blockchain infrastructure

- Building machine learning models or natural language processing tools

- Enhancing real-time data systems or cybersecurity solutions

- Improving user experience with innovative front-end/back-end architecture

If you're addressing technical challenges without obvious solutions, you're likely engaging in qualifying research and development work. This can also apply to a wide range of activities.

Need Assistance?

Alexander & Co’s in-house R&D tax credit experts have extensive experience working with tech, SaaS, and fintech clients. We can help with:

- Assess your company's eligibility under the merged R&D scheme

- Maximise your claim with strategic guidance

- Prepare compliant, accurate submissions that stand up to HMRC scrutiny

- Secure corporation tax refunds or cash credits that can fuel your next stage of growth

The way we undertake R&D claims means we only take a few hours of a company’s time. We handle the entire process ourselves, with work undertaken by fully qualified Chartered Tax Advisors and Chartered Accountants.

Ready to Optimise Your R&D Tax Credit?

If you are a digital or fintech company developing innovative tech, your firm is likely to be able to claim under the research and development tax credit scheme.

As a member of Manchester Digital, Alexander & Co is happy to provide an in-depth consultation to discuss your activity and assess whether you are likely to qualify for R&D tax relief.

You can contact Alexander & Co to arrange an R&D consultation.

- Call: 0161 832 4841

- Email: info@alexander.co.uk

- Or visit Alexander & Co’s R&D page here to learn more

Related Resources:

This article was written by Rowan Morrow-McDade, CTA ACA, Tax Director at Alexander & Co. Rowan is a Chartered Accountant, Chartered Tax Advisor and a member of the ICAEW.

Alexander & Co is a member of Manchester Digital and supports innovation through expert tax, accounting, and advisory services for the UK’s most forward-thinking businesses.