Banking technology platform provider BankiFi, in association with The Co-operative Bank, has launched a new Request to Pay (RTP) service: Incomeing, developed in Manchester. The service helps SMEs boost their cash flow by facilitating instant, cost-effective and secure collection of payments from their customers. The Co-operative Bank is the first UK provider to offer an open Request to Pay mobile application for not only its customers but also those that bank elsewhere.

Many micro and small businesses suffer as a result of high transaction fees, delayed or late payments, complex financial admin tasks and cash-flow disruption. According to research from the Federation of Small Businesses1, 30% of all payments to SMEs are late, at an average value of £6,142. Cognisant of the urgency around late payments, the UK government recently announced an overhaul of the Prompt Payment Code (PPC), cutting the payment term in half to within 30 days. Further, McKinsey2 estimates that around 74% of an SME’s time is spent on ‘non-core activities’, including time-consuming administrative tasks.

With the UK home to approximately 5.5 million micro business owners3, the Incomeing RTP service is designed to provide them with greater choice and control. The flexible technology is a more cost-effective alternative than cash, direct debits or high-fee card transactions.

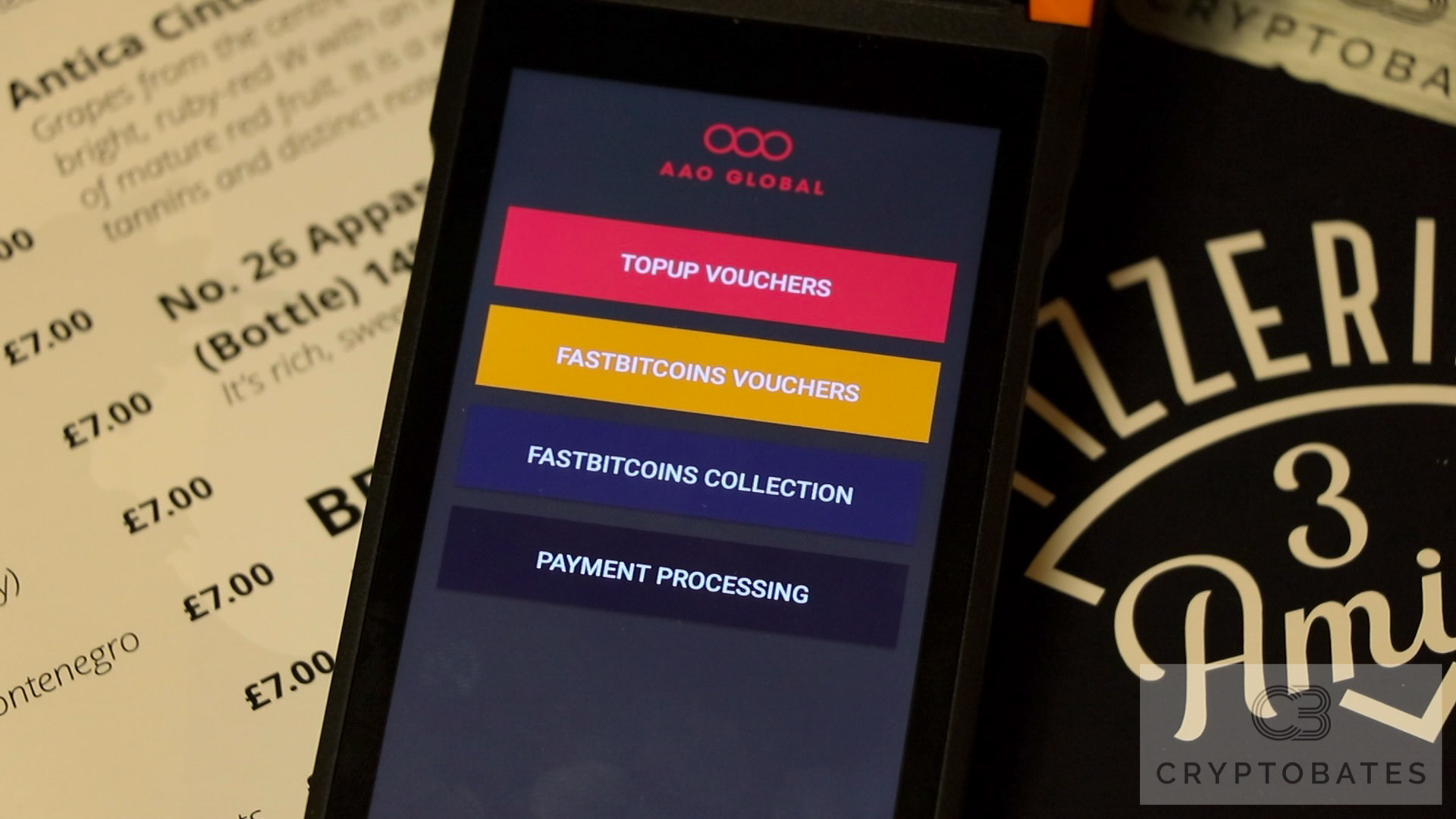

The platform allows users to send secure, real-time payment requests via text, email and Whatsapp, as well as QR codes for simple face-to-face transactions. It ensures that funds are transferred into a chosen account immediately, boosting cash flow. It also generates invoices, streamlines the process of chasing late payments and automates financial admin by integrating with all the major accounting applications.

The Co-operative Bank is the first to offer the platform to its micro and small business customers, but the Incomeing app is available to customers of any UK bank.

Stephen O’Keane, Head of Customer Transformation at The Co-operative bank comments: “Small and micro businesses have worked incredibly hard to stay afloat this year. Even before the pandemic, the pressures of late payments and impact to cash flow was an issue many SMEs were trying to manage. In association with Incomeing, The Co-operative Bank wants to help close this gap, not just to support our customers, but go beyond that and support all SMEs with an effective solution. The benefit of Incomeing is it’s a simpler but secure way of handling payments that we believe will help many businesses sustain and grow even in these challenging times.”

Mark Hartley, Founder and CEO of BankiFi, comments: “Incomeing is ultimately here to support the businesses that represent the backbone of the UK economy. SMEs typically wait longer to get paid than bigger businesses, with late payments and time spent on burdensome financial admin placing immense pressure on their survival. Being an SME ourselves, we wanted to create a service that helped business owners simplify collecting money from their customers, automate invoicing and bookkeeping, and to receive the money directly into their account - all through a mobile experience that reflects how they operate.”

“Whilst we have a global team behind us at BankiFi, Incomeing has Mancunian roots and our aim is to focus on supporting the small and micro businesses in this region initially, as part of the city’s growing tech ecosystem.”

Incomeing is also available as a white-labelled solution, meaning any organisation with an SME client base can leverage the app to offer a licensed digital payments and collection service. Data shows a large portion of micro businesses run their finances through a Personal Current account, so users are able to register using either a Business Current Account, or a Personal Current Account.

Hartley continues: “We want to support small businesses in their banking needs, and as such we also make it available as a service to enterprises, such as insurers, banks and telcos, or any (membership) organisation targeting a particular segment. They were previously unable to offer payment solutions but can now do so without needing to get their own regulatory clearance. As the technology and integrations are already in place, we’re giving enterprises in the UK and Ireland access to a more cost-effective solution with payments embedded into the overall experience that has a rapid time to market.”

1. FSB. (n.d.). FSB. Retrieved from FSB: https://www.fsb.org.uk/resource-report/time-to-act.html

2. Mckinsey. (n.d.). Mckinsey. Retrieved from Mckinsey: https://www.mckinsey.com/~/media/mckinsey/industries/financial%20services/our%20insights/how%20banks%20can%20use%20ecosystems%20to%20win%20in%20the%20sme%20 market/how-banks-can-use-ecosystems-to-win-in-the-sme-market-vf.ashx

3. EY. (n.d.). The Future of SME Banking. Retrieved from https://www.ey.com/en_uk/banking-capital- markets/what-is-the-future-of-sme-banking-in-the-uk