The mobile app gold rush is over. Consumers spent a record £120 billion on mobile apps in 2025, but that money isn't flowing to new downloads. It's concentrating in apps people already use. For anyone planning an app investment in 2026, this shift demands a fundamentally different approach.

After a decade building apps across fintech, fitness, and media, we've watched the rules change. Growth-at-all-costs is dead. What's replaced it? Operational sophistication, hybrid monetisation, and AI features that actually create switching costs.

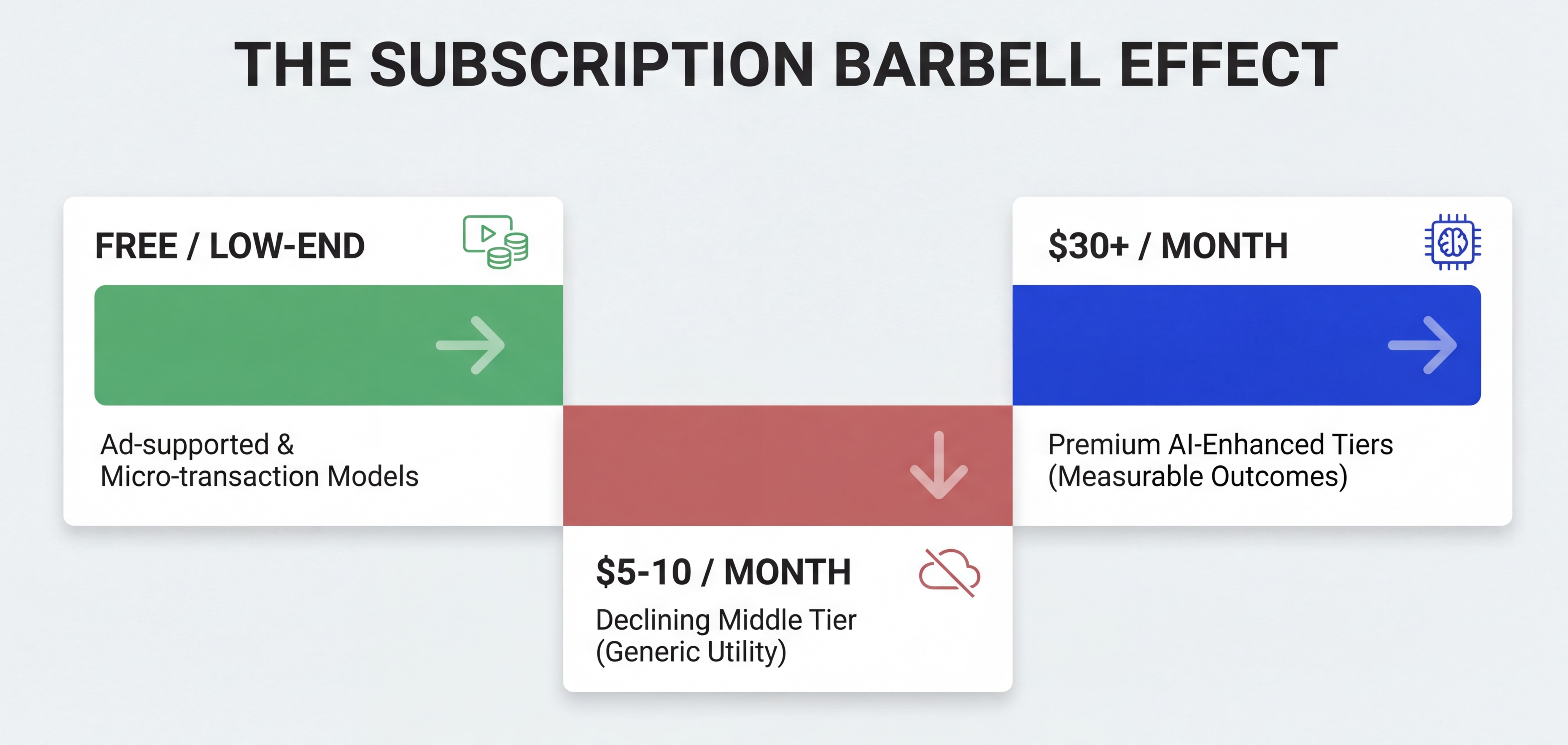

The £6.99 Subscription Is a Dead Zone

App subscriptions priced between £5 and £10 per month are failing. Users facing subscription fatigue are ruthlessly auditing their recurring expenses, and generic utility apps get cut first.

What's working instead is a barbell distribution. On one end: free apps monetised through ads and micro-transactions, serving price-sensitive users at volume. On the other: specialised apps commanding £30 to £99 per month, delivering measurable outcomes users can prove. Language fluency. Fitness gains. Business metrics.

The middle tier? Increasingly hollow.

Hybrid Monetisation Is Now Standard

Over 60% of top-grossing apps now combine multiple revenue streams rather than picking one model. Subscriptions plus consumables. Free content plus native commerce. This isn't greed. It's survival.

When we built the Bodybuilding.com app, the strategy combined free fitness tracking with e-commerce through Shopify integration. Users engage for free, but when they're browsing exercises and the app suggests relevant supplements based on their training? That's monetisation that feels helpful rather than extractive.

But hybrid models have limits. Bumble's Q3 2025 results showed paying users dropping 16% year-over-year. Simply layering consumable purchases onto a subscription doesn't work if your core product stagnates.

Web-to-App Billing Changes the Maths

The most significant structural change we've seen is apps migrating transactions away from App Store billing entirely.

Apple and Google take 15-30% of every transaction. Stripe takes roughly 3%. That 25%+ margin difference funds serious competitive advantages. The strategy involves directing users to mobile-optimised web pages for purchase, then syncing entitlements to the app.

We've implemented this through RevenueCat for subscription apps, including The Stray Ferret, a local news publication. Users subscribing via the website get better rates, and their subscription works across every platform.

The EU's Digital Markets Act technically allows alternative payment mechanisms, but adoption remains limited. Epic Games aimed for 100 million mobile installs of their alternative store. They reached 29 million. Web-to-app billing achieves similar margin benefits with less friction.

AI Wrappers vs AI-Native Apps

Every pitch deck in 2025 mentioned AI. In 2026, we can see which investments created value.

An AI wrapper passes input to a third-party API and displays the result. The intelligence is rented. As models improve and prices drop, your wrapper becomes indistinguishable from competitors renting the same APIs.

AI-native apps work differently. User interactions refine specialised models. Better results drive more usage. More usage generates more training data. The flywheel spins.

Duolingo provides the blueprint. Rather than bundling AI into their existing subscription, they created "Duolingo Max" at a higher price point. AI features are computationally expensive, so users generating the highest server costs directly subsidise them. The clever part? A £29.99 tier makes the standard subscription appear more affordable, improving conversion rates across the board.

Geography Matters More Than Ever

The "global app market" is a fiction. Different regions operate with fundamentally different dynamics.

In Nigeria, apps like OPay have evolved from mobile wallets into operating systems for daily life. Data costs are high and storage is limited, so users prefer one app handling payments, rides, and utilities over five separate downloads.

In Indonesia, government subsidies through the Kartu Prakerja programme guarantee revenue for qualified EdTech apps, shifting the model from consumer marketing to government partnership.

In Europe, compliance overhead from GDPR, the Digital Markets Act, and sustainability reporting (CSRD) adds meaningful cost that many founders underestimate.

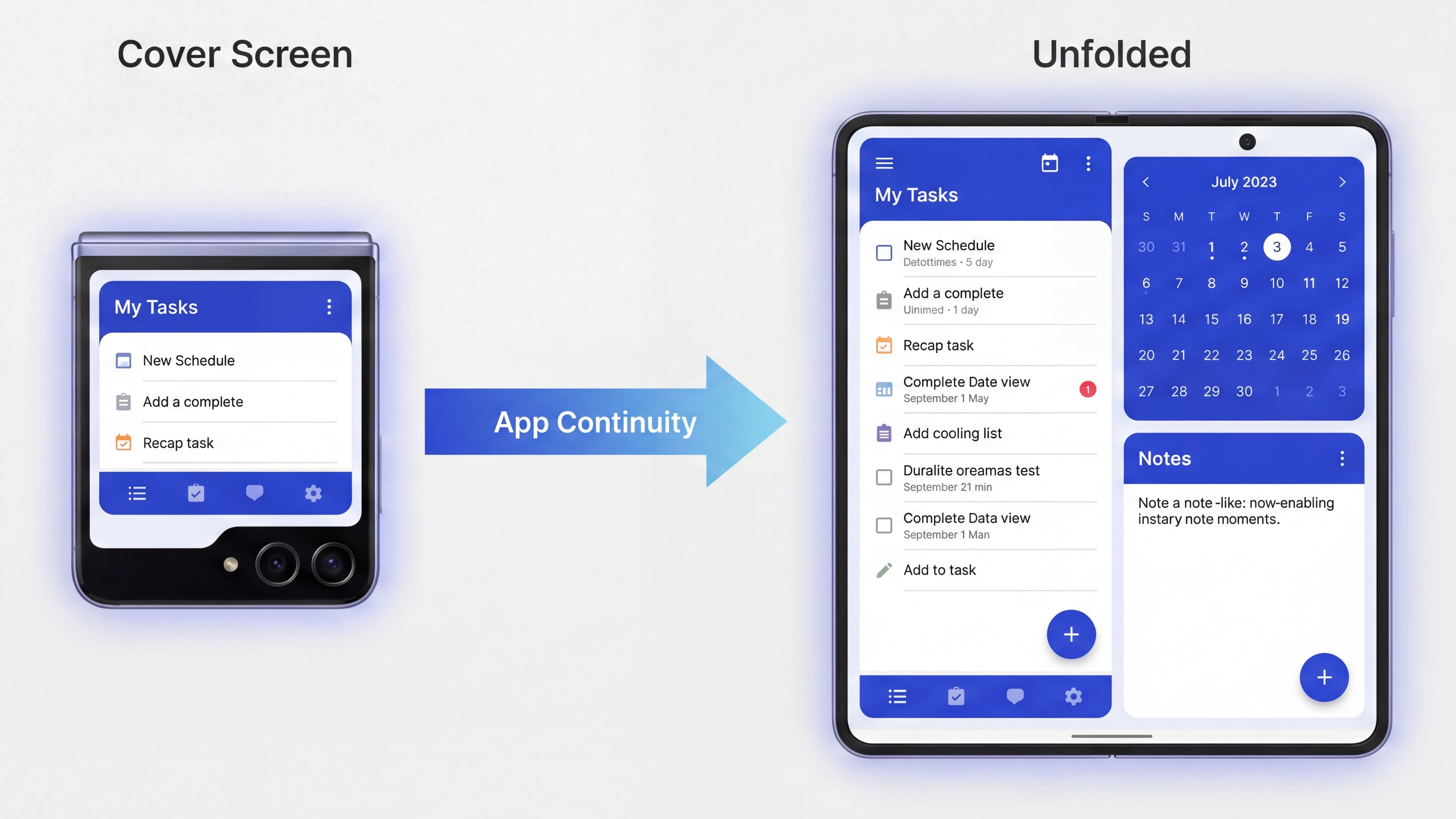

The Foldable Opportunity

Foldable smartphones are projected to grow 30% year-over-year in 2026, accelerated by Apple's expected entry with a foldable iPhone.

The foldable user is different. Devices start at £1,500+. Anyone spending that isn't going to blink at a £30/month subscription. They run multitasking workflows and treat their devices as tablet replacements for actual work.

Most apps provide identical experiences on foldable and standard devices. The few that optimise for the form factor capture disproportionate loyalty from a high-value audience competitors ignore.

What This Means for Your Next App

Pick a lane on pricing. The £6.99/month utility app is a dead zone.

Build billing flexibility from day one. Web-to-app purchase flows aren't something you bolt on later.

If you're adding AI, make sure it generates proprietary data. Can a competitor replicate your feature by calling the same API? Then it isn't defensible.

Think carefully about geography. "Global launch" is often code for "we haven't thought this through".

And don't sleep on hardware trends. Foldable optimisation feels optional today. In three years, it's table stakes for professional users.

Read the full analysis: The Mobile App Economy in 2026: Hybrid Monetisation, AI Moats, and the Foldable Opportunity

Planning an app investment? Our App Gameplan process stress-tests your monetisation strategy, technical architecture, and market positioning in four weeks. Learn more about the App Gameplan

About Foresight Mobile

Foresight Mobile is a Manchester-based app development consultancy specialising in Flutter and cross-platform development. We've delivered apps for Bodybuilding.com, The Stray Ferret, and clients across fintech, healthcare, and media. As a RevenueCat Premier Partner, we help businesses implement subscription and hybrid monetisation strategies that actually work.