More and more companies are beginning to take advantage of BNPL to increase their sales.

Unsurprisingly, BNPL has become a huge hit with younger generations; on average, over 54% of millennials and 50% of Gen Zers have used (and will continue to use) pay-later schemes!

With the increase of BNPL companies, social networks such as Facebook have really clamped down on their regulations, making sure that brands and businesses alike make users aware of the potential consequences of debt and money loaning. This new push on “responsible shopping” has undoubtedly changed the face of advertising, and this will inevitably continue to change.

We’ve broken down the new rules of using BNPL options in eCommerce and via paid social channels, how to write ad copy that’s aligned with regulations and examples of how other brands are using BNPL!

The Do’s and Don’ts of Buy Now, Pay Later

Do: Use Disclaimers

Across Facebook, Instagram, Twitter and other social media platforms, it’s crucial to include disclaimers within any ad copy. With the increase in BNPL schemes, customers need to be informed of any potential risks that may occur as a result, such as personal debt or impacts on credit scores.

For example, any ad copy that references pay later will need the following disclaimers;

- Klarna, Laybuy & More

Summer sale! Shop 50% off wardrobe essentials for any occasion! Buy now, pay later with Klarna or Laybuy* available.

*Please shop responsibly. 18+, T&Cs apply. Full details on-site.

- Clearpay

Summer sale! Shop 50% off wardrobe essentials for any occasion! Pay in 4 instalments with Clearpay* available.

*Please spend responsibly 18+ T&C’s apply. Full details on-site. With Clearpay credit, T&Cs & late fees apply clearpay.co.uk/terms.

To prevent an ad account from being flagged or at risk of being shut down, it’s important to include the disclaimers, as featured above. By including an asterisk, the disclaimer can fall below the “see more” line so that it doesn’t clutter your ad copy!

Don’t: Glorify BNPL

Advertisers shouldn’t glamourise or promote Buy Now, Pay Later schemes in any way. Any ad copy or creative designs should keep the focus away from the BNPL and instead have it featured as a background incentive.

Using language such as, “Broke until payday? Shop it now without any worry!” would be considered glamourising BNPL schemes. Instead, copy and designs should make a minimal reference to this. Adverts also need to make it explicitly clear that delayed payments are a form of credit.

Do: Link Directly

Any brands or businesses promoting Klarna, Clearpay or any other BNPL schemes should have a landing page featuring all FAQs on their website.

All ads that feature BNPL copy should always link either to the BNPL website or the landing page of FAQs to prevent being flagged by advertising standards!

Need more information on the regulations of BNPL? The marketing guides for Clearpay can be found here. And the Klarna marketing guides can be found here!

Example of Buy Now, Pay Later in eCommerce

With the strict regulations on how to advertise, we’ve picked out an example of how to feature Buy Now, Pay Later on your business site.

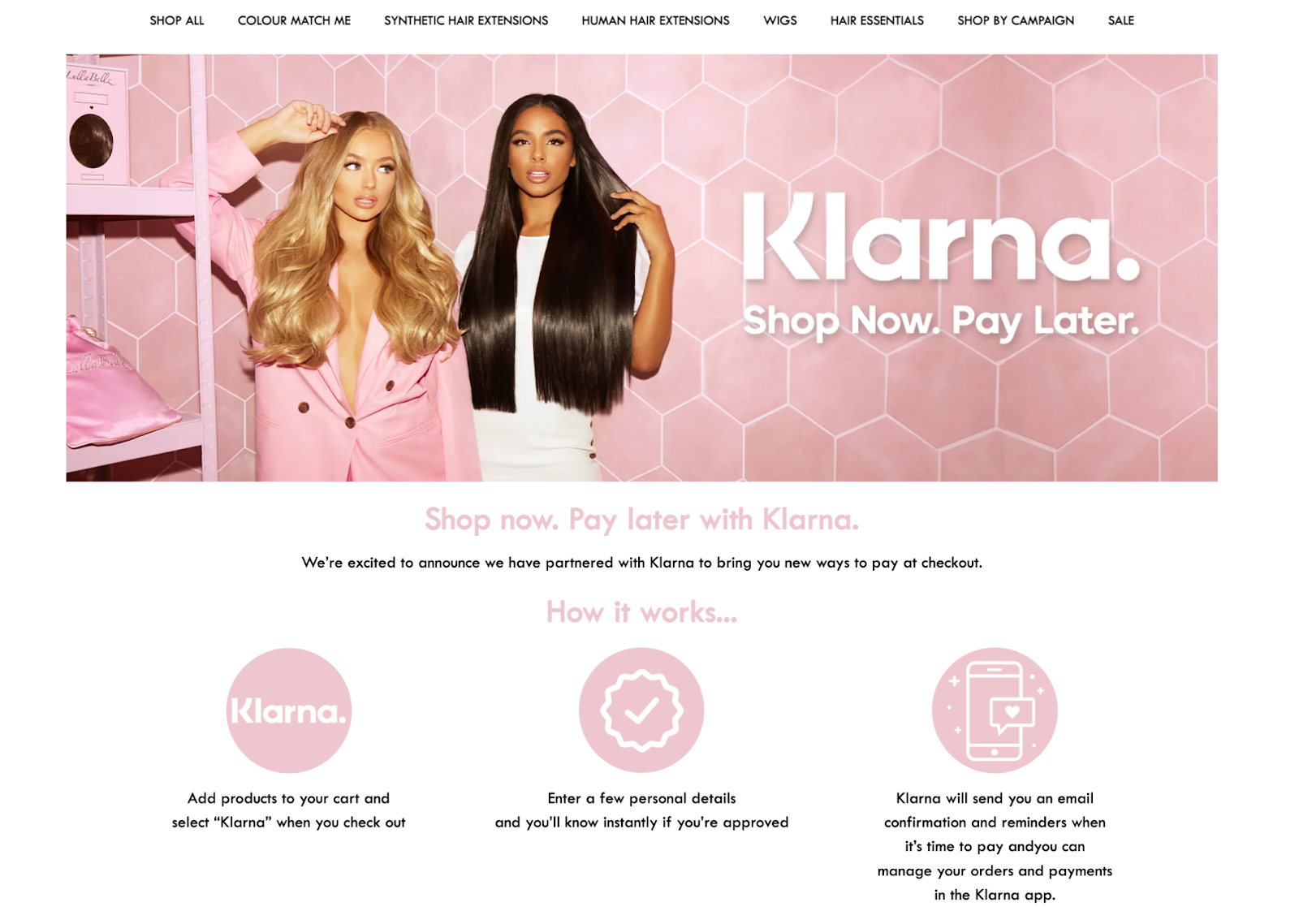

LullaBellz

The influencer-favourite hair extension brand, LullaBellz, exemplifies how to use Buy Now, Pay Later within their ads and on their website.

Their Klarna landing page is equipped with all of the information needed for Buy Now, Pay Later schemes. And all of the relevant FAQs and T&Cs are laid out and easily accessible to any customer. Additionally, all of their ad copy features relevant disclaimers!